Breadcrumb

Highlights of the annual report 2020 of the CREG

On this page, you can find a summary of a number of important developments and salient facts from the CREG 2020 Annual Report. The full PDF version of the annual report can be downloaded here.

Key national legislative developments

The most important developments in legislation which took place in the area of electricity and natural gas in Belgium in 2020 relate to:

-

the social price caps

-

the lifting of the freeze on the indexation of the social fund for gas and electricity

-

the dropped customers

-

the sanctioning powers of the CREG vis-à-vis foreign operators

-

the enhanced protection for SMEs

-

the capacity remuneration mechanism

-

the ruling of the Court of Justice of the European Union of 3 December 2020

The electricity market

Overview of a number of key figures for the electricity market in 2020 determined on the basis of preliminary figures from various sources:

- The Elia grid load was 69.9 TWh in 2020, compared with 74.2 TWh in 2019, a fall of 5.8% between 2019 and 2020. The peak capacity of this consumed energy was estimated at 12,427 MW in 2020, slightly lower than what was recorded in 2019 (12,569 MW).

- Electricity generation on the Elia grid was 70 TWh, compared to 75.8 TWh in 2019. Generation by nuclear power plants fell by 23% (31.9 TWh compared to 41.4 TWh). The natural gas-fired units produced 20.8 TWh, a limited increase (0.5 TWh) compared to 2019. Generation from solar panels increased significantly to 4.3 TWh in 2020. The dominant market share of Electrabel increased to 73% in 2020 (compared to 72% in 2019). The HHI index decreased slightly to 5,648 in 2020, which still points to a highly concentrated market for electricity generation.

- A limited net volume of 0.4 TWh was exported while strong imports were expected due to lower nuclear power plant injection volumes.

- The average daily market price in Belgium was €31.91/MWh, lower than the €32.21/MWh in France and the €32.24/MWh in the Netherlands. By way of comparison, in 2019 the daily market price in Belgium was €39.35/MWh. The average German daily market price in 2020 also fell compared to 2019, but at €30.47/MWh remained the lowest in the CWE region. However, the fall in the price on the daily market was strongest in the Netherlands (-€9/MWh).

Average annual prices for the period 2007-2020 of the day-ahead market for delivery of electricity in the countries of the CWE region (Sources: EPEX SPOT Belgium, EPEX SPOT, CREG calculations) - On the long-term market for electricity, the year-ahead price for delivery in 2021 fell by one fifth, to €40.7/MWh. In 2020, the average price on the short-term market was therefore slightly lower than the average price of a year-ahead contract.

- The two most conspicuous changes in the area of interconnections in 2020 were undoubtedly the entry into force of Regulation (EU) 2019/943 and the commissioning of the HVDC connection ALEGrO between Belgium and Germany. Both changes prompted adaptations to the CWE Flow Based market coupling. These adaptations were approved by the CREG on 3 September 2020.

- Price convergence was also reasonably maintained in 2020 between the short-term market and the positive and negative imbalance tariffs.

Average unweighted imbalance tariff and EPEX SPOT DAM price during the period 2007-2020 (Sources: Elia data and BELPEX/EPEX SPOT)

The CREG continued to stress consumer protection and information aspect of its work in 2020:

- With the CREG Scan launched in February 2017, the CREG offers consumers a unique and convenient tool that allows them to compare their (dormant or active) contract with the current market offering, in six clicks. A campaign through Facebook and Google Ads in 2020 to raise awareness of the CREG Scan also generated impressive results.

- At the end of 2020, the CREG produced explanatory videos on electricity and natural gas contracts.

- The CREG continued to keep consumers informed, in particular regarding prices and their evolution, among other things via the annual study on the evolution of the components of electricity and natural gas prices, the monitoring of prices on the energy market for households and small professional users, the study on the supply of large industrial customers in Belgium, the analysis of the impact of the corona crisis on the Belgian wholesale markets for electricity and natural gas, the study on the composition of the product portfolios of the various suppliers on the Belgian electricity and natural gas market for households and the publication of key figures on the energy market.

- The CREG continued publishing the infographics and monthly dashboard for electricity and natural gas on its website, to provide consumers with all the necessary information to make a reasoned decision.

- The electricity transmission tariffs applicable in 2020 decreased overall by 2.1% compared to 2019.

The natural gas market

The most important aspects of the natural gas market in 2020 are:

- Belgian natural gas consumption amounted to 190.7 TWh in the corona year 2020, i.e. a decrease of 1.1% compared to 2019 (192.8 TWh), which is mainly due to the decrease in consumption on the distribution networks (- 4.3%). Industrial natural gas consumption fell slightly (-0.9%), while natural gas consumption by natural gas-fired power stations rose by 4.5%.

Distribution of Belgian H gas and L gas demand by user segment in 2019 and 2020 (Source: CREG) - On 10 December 2020, the CREG approved the integration of the Zelzate 2 interconnection point into VIP BENE (virtual interconnection point on the Belgian-Dutch border) as a result of Gas Transport Services BV (GTS), the operator of the Dutch gas transport network, taking over the adjacent Zebra network (effective 1 January 2021).

- On 10 December 2020, the CREG also approved the coordination of the definitions and services relating to the injection of other gases (including biomethane) into the natural gas transmission grid.

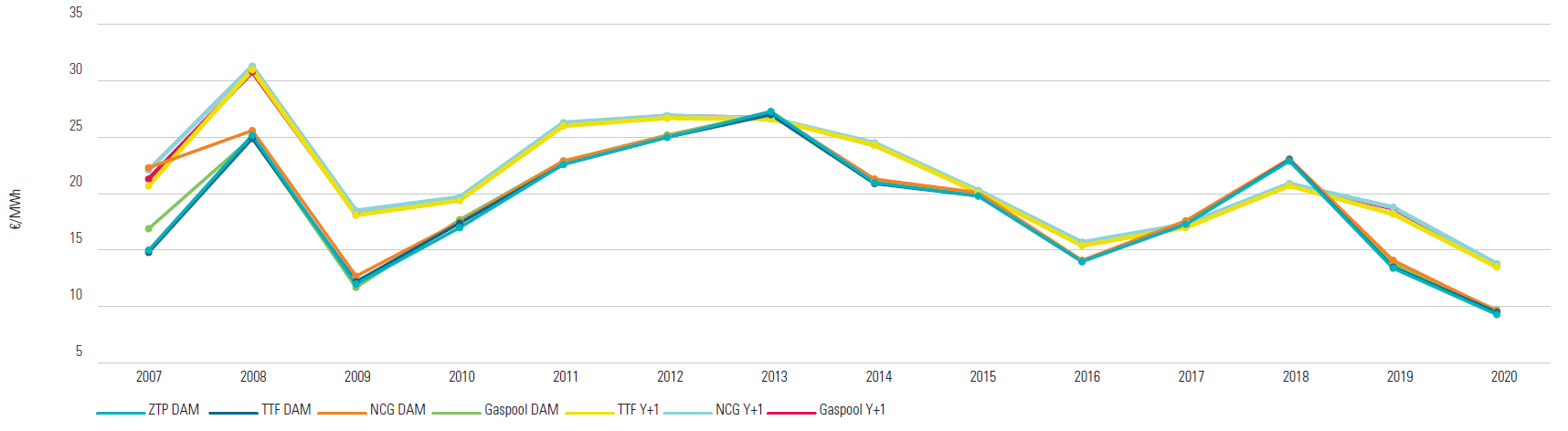

- The average gas price on the short-term market fell sharply in 2020, to €9.4/MWh (€13.7/MWh in 2019) and fell on the long-term market to €13.7/MWh (€18.6/MWh in 2019). Average natural gas prices on the short-term market in Belgium show a difference of 1% between TTF and ZTP.

Average annual natural gas price on the day-ahead and year-ahead markets (Sources: CREG, data taken from icis.com, ice.com, eex.com and powernext.com) - The CREG carried out a study on the prices in force on the Belgian natural gas market in which it analysed market shares, price setting, price levels, price breakdown and billing in the different segments (import, resale, supply of residential customers, industrial customers and power plants) of the Belgian natural gas market.

- The CREG continued to emphasise improving the functioning of the natural gas market, in order to protect the interests of consumers. These aspects are presented in the chapter Electricity.

- The natural gas transmission tariffs for the regulatory period 2020-2023 fell by approximately 5% compared to the indexed tariffs for 2019.

The CREG

This chapter describes the functioning of the CREG and the close relations it maintains with other national and international bodies.

It also contains a list of the acts which the Board of Directors approved in 2020.